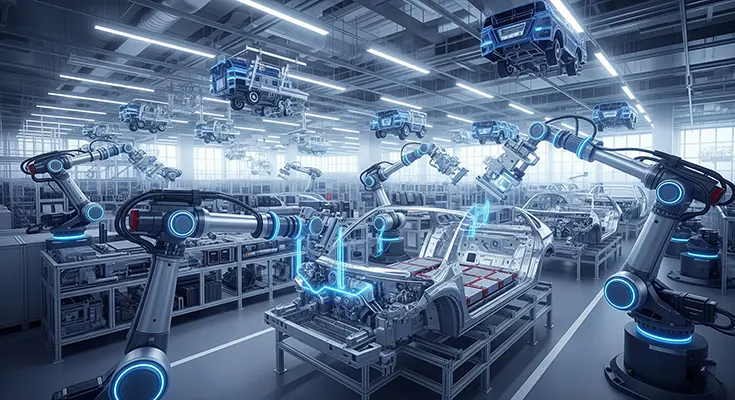

Central and Eastern Europe (CEE) has long been the powerhouse of the European automotive industry, serving as the “integrated periphery” for major Western European car manufacturers. With a skilled workforce and a strategic location, countries like the Czech Republic, Slovakia, and Hungary have become crucial hubs for vehicle assembly and component production. However, as the industry undergoes its most profound transformation in a century, the future of these supply chains is far from certain. The shift to electric vehicles (EVs) and the increasing digitalization of cars are creating both immense challenges and new opportunities for the region.

The Challenge of the EV Transition: A Looming Disruption

The move away from internal combustion engines (ICE) to electric powertrains poses a fundamental threat to the existing CEE supply chain model.

- Fewer Moving Parts: An electric motor has significantly fewer moving parts than a traditional engine. This simple fact could render large parts of the existing CEE supplier base—which specializes in everything from fuel injection systems to exhaust components—obsolete. Many smaller and medium-sized enterprises (SMEs) that have thrived on the ICE ecosystem now face the difficult task of re-tooling their production and reskilling their workforce.

- Dependence on Western OEMs: The CEE region’s success has been built on its deep integration into the value chains of German and other Western European carmakers. As these OEMs shift their focus and investment to EV production, CEE suppliers must follow suit or risk being left behind. This dependency, while historically a strength, can now be a vulnerability if local suppliers are too slow to adapt.

- Competition from New Players: The EV transition has opened the door to new players, particularly from China, who are bringing their own highly integrated and efficient supply chains to Europe. The influx of Chinese investment in CEE, particularly in battery production, poses a direct challenge to the established order. While this investment brings jobs and new technology, it also deepens the region’s role as a low-cost assembly hub rather than a center for high-value R&D and innovation.

Opportunities for Re-shaping the Supply Chain

Despite these formidable challenges, the EV transition is also creating new avenues for growth and a chance for the CEE region to upgrade its position in the global value chain.

- Battery Manufacturing Hub: The region has emerged as a key hub for battery production. Countries like Hungary, Poland, and the Czech Republic have successfully attracted multi-billion-euro investments from Asian battery giants like CATL, LG Energy Solution, and Samsung SDI. This positions CEE at the very heart of the new automotive supply chain, providing a crucial and highly valuable component for EVs produced across Europe.

- Semiconductor and Software Development: The modern car is essentially a computer on wheels, requiring an exponential increase in semiconductors and software. While Western European countries have traditionally held the lead in R&D, CEE countries have a significant opportunity to leverage their highly skilled and cost-competitive workforce in software engineering, data science, and electronics. This could transform the region from a manufacturing base to a hub for high-tech, knowledge-intensive activities. The recent decision to build a major semiconductor plant in Dresden, Germany, also creates new opportunities for CEE suppliers who are deeply embedded in the German production network.

- Nearshoring and Resilience: The lessons of the global semiconductor shortage and geopolitical instability have prompted Western OEMs to reassess their over-reliance on distant and complex supply chains. This trend of “nearshoring” or “reshoring” to Europe strengthens the CEE region’s position as a logical and resilient alternative, offering geographical proximity and established industrial infrastructure.

The Road Ahead: A Call for Strategic Action

The future of CEE’s automotive supply chain is at a critical juncture. To avoid becoming a mere “integrated periphery” producing lower-value components, the region’s governments and industries must make strategic choices. This includes investing in re-skilling the workforce, fostering local R&D and innovation ecosystems, and attracting foreign direct investment that brings not only production but also intellectual property and high-value-added activities. The transition is not just about changing what is produced, but about upgrading how it is produced and where the value is created. The path ahead is challenging, but with a forward-looking strategy, Central and Eastern Europe can solidify its place not just as Europe’s factory floor, but as a key architect of its electric and digital future.