Germany’s luxury car brands—synonymous with engineering excellence, premium quality, and global prestige—are facing a perfect storm of challenges in 2025. While their rich history and brand loyalty provide a strong foundation, the convergence of a seismic industry transition, intense competition, and a shifting global economic landscape is putting their traditional dominance to the test. The “Made in Germany” label, once a guarantee of market leadership, is now navigating a complex and uncertain future.

The Electric Vehicle Revolution: A Race Against Time

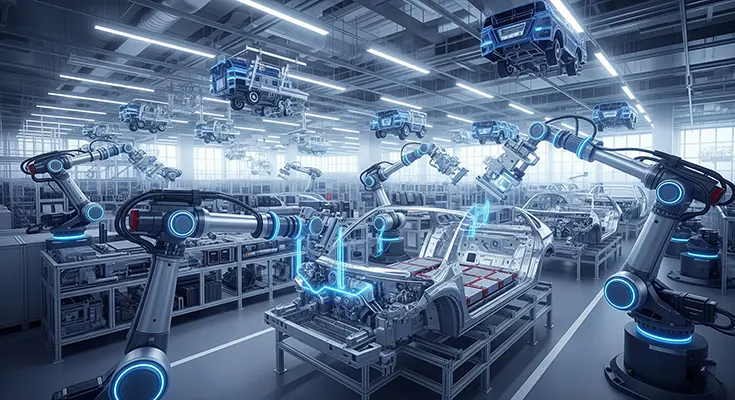

The most significant challenge for German luxury manufacturers is the rapid and mandatory transition to electric vehicles (EVs). The European Union’s 2035 deadline for a ban on new internal combustion engine (ICE) sales has accelerated a strategic pivot that is proving both costly and complex.

- Massive Investment and R&D: German automakers are pouring billions of euros into developing new electric-first platforms, software, and battery technology. This monumental investment has put pressure on profitability, particularly as the initial EV models have struggled to match the margins of their high-end ICE predecessors.

- Catching Up on Software: For years, German brands led the world in hardware engineering. However, the EV era is a software-defined one, and the industry has been forced to play catch-up with agile tech-first competitors like Tesla. Creating seamless, user-friendly, and bug-free in-car digital ecosystems has become a major hurdle, with software-related issues often delaying vehicle launches.

- Supply Chain Overhaul: The shift to EVs requires a fundamental reimagining of the supply chain. Sourcing critical minerals for batteries, establishing secure battery manufacturing capabilities, and managing a new network of suppliers for electric components is a daunting task, leaving these companies vulnerable to shortages and geopolitical risks.

The Threat from the East: Competition in the World’s Largest Market

The rise of Chinese automakers presents an existential threat to German luxury brands, particularly in the critical Chinese market. Once a dominant force in China, German manufacturers are seeing their market share erode at an alarming rate.

- Chinese EV Dominance: Chinese brands, led by powerhouses like BYD, have taken the lead in the EV transition with a combination of speed, innovation, and competitive pricing. They are launching new, tech-packed models at a pace that legacy automakers struggle to match, appealing directly to the younger, more digitally savvy consumer.

- Price and Affordability: The German luxury market in China is facing an “affordability crisis” as rising prices for their new electrified models collide with fierce price competition from local rivals. This has led to a decline in sales and a weakening of the traditional German brand premium.

- Loss of Identity: German luxury brands are finding it increasingly difficult to differentiate themselves in a market saturated with high-tech, feature-rich EVs. Where their legacy of performance and design once set them apart, Chinese brands are now offering advanced autonomous driving features and impressive digital interiors that often exceed what their German counterparts can provide.

Broader Economic and Geopolitical Headwinds

Beyond the automotive-specific challenges, Germany’s luxury carmakers are also grappling with wider economic and political forces.

- Weak Global Demand: Economic uncertainty in key markets is dampening consumer confidence and demand for high-ticket items like luxury cars. High inflation and rising interest rates are making vehicle financing more expensive, further suppressing sales.

- Geopolitical Risks and Tariffs: The specter of trade wars and tariffs looms large. EU tariffs on Chinese EVs, and the potential for retaliatory tariffs on German exports to China and the United States, create an unpredictable and volatile operating environment.

- Supplier Crisis and Job Cuts: The transition to EVs is not only affecting the major car manufacturers but also the vast network of smaller suppliers who specialize in ICE components. Many are facing the difficult task of reinventing their business models, leading to widespread job losses and further economic strain on the industry.

Despite these significant hurdles, German luxury brands are not giving in. They are responding with massive investments, strategic partnerships (including with Chinese tech companies), and a renewed focus on innovation. The coming years will be a test of their resilience and ability to adapt. The brands that successfully navigate this complex landscape will be the ones that define the future of luxury mobility.