The European Union has consistently been at the forefront of global efforts to combat climate change, and its ambitious emissions regulations have had a profound and transformative impact on the automotive industry. For European car manufacturers, these regulations are not merely guidelines; they are powerful drivers of innovation, strategic shifts, and, at times, significant challenges. From the early Euro standards to the stringent CO2 targets, EU policies have fundamentally reshaped how cars are designed, produced, and marketed across the continent.

The Genesis of Change: Euro Standards and CO2 Targets

The journey began decades ago with the introduction of “Euro” emissions standards, progressively limiting pollutants like nitrogen oxides (NOx) and particulate matter (PM) from vehicle exhausts. These standards pushed manufacturers to develop more efficient internal combustion engines (ICE) and advanced exhaust after-treatment systems.

However, the most significant shift came with the implementation of fleet-wide CO2 emission targets. Starting with the 2020/2021 targets, which mandated a fleet average of 95g CO2/km for new passenger cars, and subsequently tightening to a 55% reduction by 2030 (compared to 2021 levels) and a full 100% reduction by 2035, the EU effectively signaled the end of the road for new ICE vehicle sales. This aggressive timeline forced a radical rethink across the industry.

The Electrification Imperative: A Race Against Time

The most direct and visible impact of these regulations has been the accelerated pivot towards electrification. For European car manufacturers, investing heavily in electric vehicles (EVs) is no longer an option but a necessity to avoid hefty fines for non-compliance.

- Massive R&D Investment: Billions have been poured into research and development for battery technology, electric powertrains, charging infrastructure, and dedicated EV platforms. Companies like Volkswagen, Mercedes-Benz, and Stellantis have committed to multi-billion euro investments in their electric future.

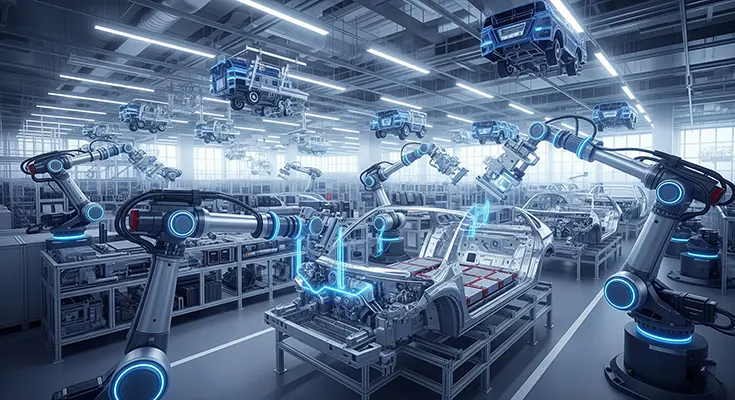

- New Production Facilities: Existing factories are being re-tooled, and entirely new gigafactories are being built across Europe to produce batteries and electric vehicles. This brings both economic opportunities and the challenge of managing a complex industrial transition.

- Strategic Partnerships: Collaborations with battery suppliers, software companies, and even rival manufacturers have become commonplace to share costs and accelerate technological development.

Shifting Product Portfolios and Market Dynamics

The regulatory pressure has directly influenced the types of vehicles European manufacturers offer:

- PHEV as a Bridge: Plug-in hybrid electric vehicles (PHEVs) initially served as a crucial bridge technology, allowing manufacturers to lower their fleet-average emissions while full battery electric vehicle (BEV) production ramped up. However, as 2035 approaches, the focus is increasingly on pure BEVs.

- Focus on Smaller and More Efficient Models: While demand for SUVs remains strong, regulations incentivize the development of more aerodynamically efficient and smaller vehicles, especially within the EV segment, to maximize range and minimize energy consumption.

- Premium EV Dominance: Initially, many European manufacturers launched premium and luxury EVs, leveraging higher price points to offset the significant R&D costs. However, the next phase sees a strong push into more affordable, mass-market electric vehicles to capture a wider audience and meet the 2035 mandate.

Supply Chain Transformation and Geopolitical Considerations

Meeting the demand for EVs requires a complete overhaul of the automotive supply chain. This includes:

- Battery Raw Materials: Securing a stable and ethical supply of critical raw materials like lithium, cobalt, and nickel has become a strategic priority. This has led to investments in mining, refining, and recycling within Europe and diversification away from single-source reliance.

- Localizing Production: There’s a strong drive to localize battery cell and module production within Europe to reduce reliance on Asian suppliers, enhance supply chain resilience, and create jobs.

- Software Development: EVs are essentially computers on wheels. This has pushed carmakers to rapidly expand their in-house software capabilities, often competing with tech giants for talent.

Challenges and Opportunities

While the transition is profound, it’s not without its hurdles:

- Cost of Transition: The sheer investment required to transition from ICE to EV technology is immense, putting pressure on profitability, especially for smaller manufacturers.

- Consumer Acceptance and Infrastructure: Despite growing interest, the pace of EV adoption depends on factors like purchase price parity, widespread charging infrastructure, and addressing range anxiety.

- Competition: European manufacturers face stiff competition from established Asian EV giants (e.g., BYD, Geely) and increasingly from new entrants and tech companies.

However, the regulations also present significant opportunities:

- Global Leadership in Green Tech: By leading the charge in sustainable mobility, European manufacturers can strengthen their position as innovators and exporters of advanced EV technology.

- Brand Repositioning: Embracing electrification allows brands to align with modern environmental values, attracting a new generation of customers.

- New Revenue Streams: The shift opens doors for new business models, including energy services, charging solutions, and software-defined vehicle features.

In conclusion, the EU’s emissions regulations are the single most influential factor shaping the future of European car manufacturing. They have ushered in an era of unprecedented technological change, demanding massive investments, strategic reorientations, and a fundamental shift in business models. While the road ahead is challenging, these regulations are ultimately driving Europe’s automotive industry towards a cleaner, more sustainable, and technologically advanced future.